|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

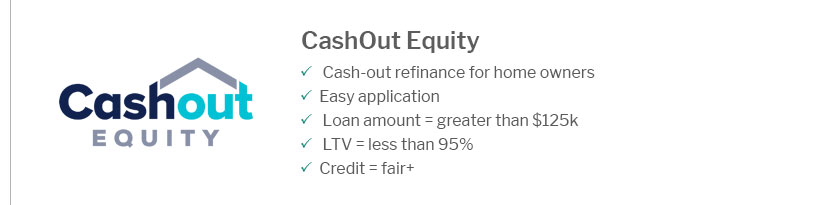

Understanding Down Payment to Refinance Mortgage: A Comprehensive GuideRefinancing a mortgage can be a strategic move to save money, but many homeowners have questions about down payments. This guide explores the ins and outs of the down payment requirements when refinancing your mortgage. What is a Down Payment in Refinancing?A down payment is a percentage of the property's value that the borrower pays upfront. In the context of refinancing, the term 'down payment' can sometimes be misleading because it differs from the initial home purchase. Is a Down Payment Required?Unlike purchasing a home, refinancing often does not require a traditional down payment. Instead, lenders may evaluate the home's equity to determine your eligibility. Equity as a SubstituteHome equity plays a crucial role. The more equity you have, the better your chances of refinancing without a down payment. Some lenders offer a no down payment refinance mortgage option if you meet certain equity criteria. Factors Affecting Refinancing DecisionsSeveral factors influence whether a down payment is necessary when refinancing:

Closing CostsEven if a down payment isn't required, closing costs can be significant. Understanding the new jersey refinance closing costs can help you budget effectively. Benefits of Refinancing Without a Down PaymentRefinancing without a down payment can maintain liquidity and potentially offer better financial flexibility.

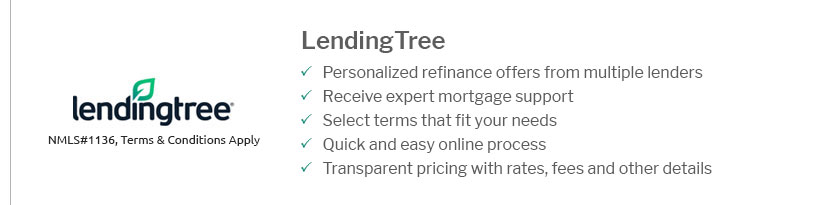

FAQ SectionCan I refinance my mortgage without any down payment?Yes, many lenders allow refinancing without a down payment, especially if you have sufficient home equity. How does my credit score affect the need for a down payment?A higher credit score can improve your refinancing terms, potentially eliminating the need for a down payment. Are there any drawbacks to refinancing without a down payment?While it preserves cash, you might incur higher interest rates or fees compared to putting money down. https://www.lendingtree.com/home/refinance/how-to-lower-mortgage-payment/

If you made less than a 20% down payment on a conventional loan or took out an FHA loan, you're likely paying for mortgage insurance. You could easily be paying ... https://www.youtube.com/watch?v=VCjLB1bb4Kk

Do I Need Down Payment To Refinance? Refinancing a mortgage can be a smart financial move for homeowners looking to lower their interest ... https://www.youtube.com/watch?v=UIEzs-e2izE

Join Rental Property Mastery, my coaching & learning community: https://www.coachcarson.com/RPM-YT Episode 326b - Ask Coach!

|

|---|